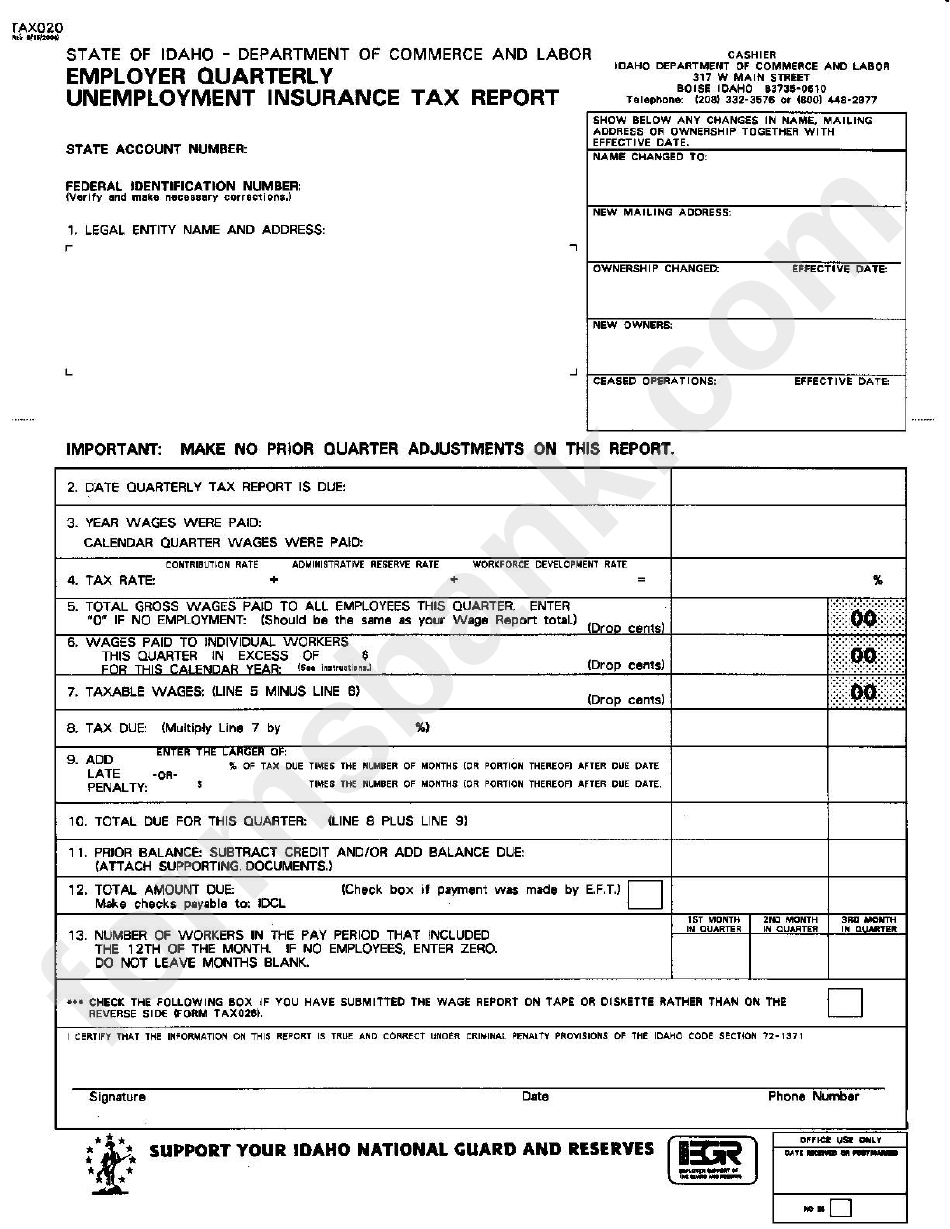

Only the first 7,000 of wages paid to each employee by their employer in a calendar year is taxable. The office is open to the public from 8:30 am to 4:30 pm. Reemployment tax is paid by employers and the tax collected is deposited into the Unemployment Compensation Trust Fund for the sole purpose of paying reemployment assistance benefits to eligible claimants. The Department of Employment Services Tax Division is located at 4058 Minnesota Avenue NE, 4th Floor, Washington, DC 20019. 8 percent, instead of 6.2 percent, of the first $7,000 they pay to each employee in a calendar year. The 1099-G tax form includes the amount of benefits paid to you for any the following programs: Unemployment Insurance (UI), Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC), Extended Benefits (EB), Federal Pandemic Unemployment Compensation (FPUC), and Lost Wages Assistance (LWA). Employers who receive the offset credit currently pay a federal employment tax of. For instructions, see the Guide to Unemployment Tax Functions in NEworks. Total taxable unemployment compensation includes the new federal programs. As taxable income, these payments must be reported on your state and federal tax return. Form 1099-G reports the total taxable income we issue you in a calendar year and is reported to the IRS. The federal employment tax is legislated by the Federal Unemployment Tax Act and is known as the FUTA tax.Įmployers who submit state tax reports and pay state tax contributions on a timely basis, receive, from the IRS, a 90 percent offset credit against the federal employment tax that they owe. All Unemployment Insurance Tax functions should be completed online at . 2021 Individual Income Tax Information for Unemployment Insurance Recipients.

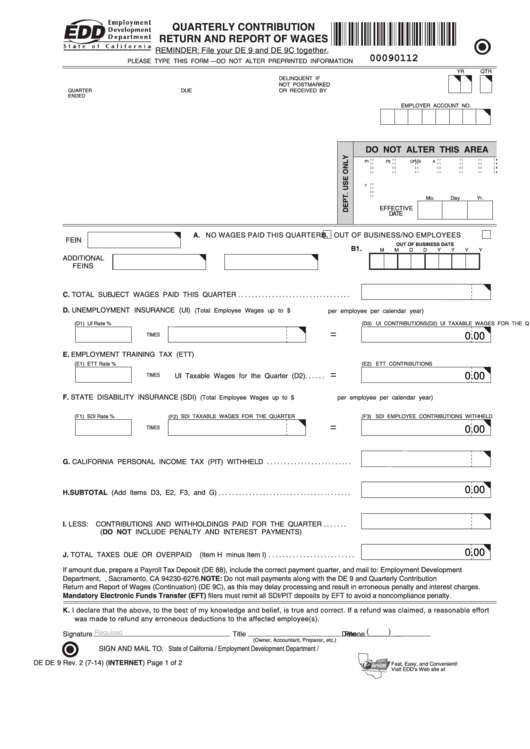

The federal employment tax that employers pay to the Internal Revenue Service (IRS) each April finances the administrative costs of state unemployment and job service programs, as well as the federal share of programs that provide for extensions of the payment of benefits to unemployed workers, and the provision of repayable federal loans to states who have depleted their benefit accounts. These monies are deposited in the District's Unemployment Insurance Trust Fund account in the US Treasury, and may only be used for payment of unemployment insurance benefits. The state unemployment tax that District of Columbia employers pay to the Department of Employment Services (DOES), on the first $9,000 of wages paid to each employee, finances the unemployment benefits that unemployed District workers receive. The cost of the unemployment insurance program is financed by employers who pay state and federal taxes on part of the wages paid to each employee in a calendar year.

The benefits paid to unemployed workers reduce the hardship of unemployment, help to maintain purchasing power of the unemployed, thereby supporting the local economy, and help to stabilize the workforce so that local workers are available to employers when they are ready to re-employ. Unemployment insurance is a federal-state program that provides temporary benefits to workers who become unemployed through no fault of their own, and who are able and available for work.

0 kommentar(er)

0 kommentar(er)